Explaining Employer Lien Recovery in Virginia

Most self-insured employers and carriers understand that the Virginia Workers’ Compensation Act permits an injured worker the right to recover from a negligent third party full damages for injuries inflicted on him or her by such party; and, from the recovery, the employer is reimbursed its lien for compensation benefits paid, subject to its pro rata share of attorney’s fees and costs. But often, a plaintiff’s attorney will argue that the proceeds of that third-party settlement should be reduced or split in thirds, meaning a third for the plaintiff/injured worker, a third for the plaintiff’s attorney, and a third for the workers’ compensation carrier. In reality, the subrogation statutes in the Virginia Workers’ Compensation Act (Section 65.2-309 and 310) that govern the subrogation rights of an employer provide for a more complex and equitable distribution of the proceeds of a third-party settlement.

Subrogation is the substitution of one party in the place of another with reference to a lawful claim, demand, or right so that the substituted party succeeds to the rights of the other. Virginia Code § 65.2-309 governs an employer’s right to claim subrogation. Subsection (A) of 65.2-309 provides that “a claim against an employer under this title for injury [. . .] shall create a lien on behalf of the employer against any verdict or settlement arising from any right to recover damages which the injured employee [. . .] may have against any other party.” In addition, the subrogation statute prevents an injured worker from obtaining a double recovery of funds already paid to him by the employer. The Act also penalizes an employee who settles their third-party action without the consent of the employer/carrier. The penalty for impairing the employer’s right may be the loss of the employee’s right to compensation benefits.

Often, a carrier may present the total amount they have paid out on a claim, to include costs from vendors and defense attorney’s fees. However, the employer and carrier do not have a right of subrogation for certain expenses, including bill review fees, nurse case manager fees, and vocational rehabilitation counselors. Thus, those expenses need to be deducted from the total lien, before calculating the gross lien. Also, any portion of the employee’s recovery that was received based upon the employee’s own Underinsured Motorist coverage does not apply to the workers’ compensation claim for an offset.

While an employer is entitled to recoupment of their lien, the employer must pay their share of the third-party attorney’s costs and fees. As a result, there is a calculation of the employer’s share of those costs and fees, in relation to the total recovery. The Commission requires approval of any third-party offset, and thus stipulations or settlement documents must be filed to approve the offset. The Commission requires the following information in order to approve a calculation of the employer’s offset:

1. The date of the third-party settlement;

2. The total amount of the third-party settlement;

3. The total amount of the carrier’s original lien;

4. The amount the carrier recovered from the original lien;

5. The total amount of the third-party costs; and

6. The total amount of the third-party settlement attorney-fees.

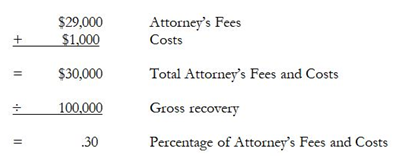

A simple example of the calculation of the offset demonstrates the method of calculation. Imagine if an employee receives $100,000.00 in a third-party settlement, and the employer has paid $50,000.00 in lost wage and medical expenses. The total amount of attorney’s fees is $29,000.00, and costs are $1,000.00.

Step One: Calculate the sum of attorney’s fees and costs and divide it by the gross recovery. This yields a percentage share of fees and costs owed by the insurance carrier at the time of the recovery. In our example, the calculation of the offset percentage is as follows:

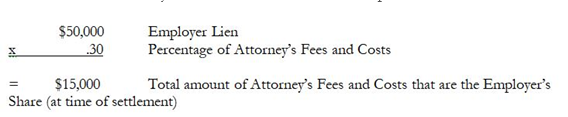

Step two: The carrier’s lien is then multiplied by the percentage of attorney’s fees and costs, which yields the pro rata share. The carrier must deduct from the lien that pro rata share, as they are responsible for that portion of the attorney’s fees and costs. The net amount is then received by the carrier in satisfaction of their present lien.

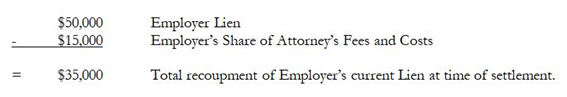

Step three: The employer then must reduce this amount of attorney’s fees and costs from their lien amount, in satisfaction of its present lien.

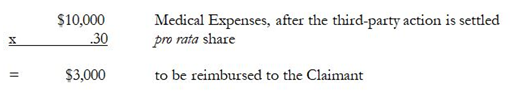

If additional lost wage benefits or medical expenses are paid, the claimant remains entitled to a reimbursement of the pro rata share of any additional benefits incurred after the third-party settlement (65.2-313), up to the value of the gross recovery. Thus, if the claimant receives benefits totaling an additional $10,000.00, the claimant remains entitled to a reimbursement of 30% of any additional benefits incurred, until the amount of benefits totals the gross recovery of the third-party action.

Usually such reimbursement requests should be submitted to the carrier directly on a quarterly basis.

Ideally, a third-party settlement is an excellent opportunity to proceed with a global settlement, where the injured worker settles all claim for his or her accident (civil and workers’ compensation). Often, consideration can be given in the form of reducing the workers’ compensation lien, rather than proffering more money to settle a claim. Such an agreement requires a petition and order to be submitted to the Commission for approval and should state that the workers’ compensation lien has been reduced as part of the settlement.

______________________________________________________________________________________________________________

Should you have any questions about the cases discussed here or other legal issues, please do not hesitate to contact the lawyers at Ford Richardson.

Ford Richardson is a full-service law firm with headquarters located in Richmond’s financial district and satellite offices in Southwest Virginia, Northern Virginia and Hampton Roads.

Our commitment to our clients is simple: offer top-tier clear legal solutions that allow our clients to excel in their business.

We are privileged to give back to our community and believe it is our responsibility to do so. Our attorneys and support staff serve as leaders and volunteers to a wide array of civic and charitable organizations.

Posted In: E-Blast